Loan management software is a cloud based end to end lending application used to improve the quality, turnaround time and service for end-customers. It enables banks to improve the agility, transparency and efficiency of their lending solutions whereas, Loan management system means an innovative, turn-key, end-to-end securities-based lending platform that connects lenders seeking high-quality, collateralized loans with borrowers requiring convenient access to credit.

The Loan Management System helps to automate the servicing and management of multiple lending portfolios on a single platform. The solution provides a comprehensive set of customer and account centric business operations which enable organizations to be more agile and also offers front office customer support capability.

Better manage the customer life-cycle with ease of handling part payments, foreclosures, re-structuring and control portfolio quality with provisioning and accounting configurations to achieve greater profitability through the Loan Management System.

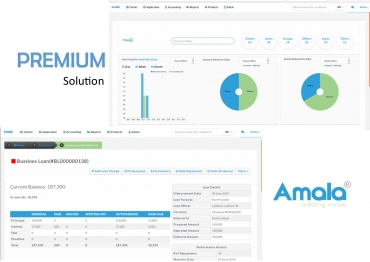

Amala App Suite is an advanced and comprehensive financial loan management system that aims to improve the quality, turnaround time and service for end-customers. It enables Microfinance Institutions to improve the agility, transparency and efficiency of their lending solutions. As a loan management solution, it enables financial institutions to automate the processes for achieving cost savings and enhanced customer experience

It also supports multiple facets of Loan portfolio starting from prospecting to closure and monitoring. The comprehensive loan management solution facilitates financial institutions to automate the procedures for achieving cost savings and better customer experience. We deliver tech enabled lending processes that improve productivity and customer service through the entire loan lifecycle.

- Amala App suite can facilitate the tracking of your Prepaid loans , and for saccos it can allow the import of payroll deductions.

- Also It can track all loan guarantors either self, internal or external and their collateral and keep track of all top up loans made.

- It can facilitate Member/Loan statement which explain repayment schedule and allow the print of receipt of any loan transaction.

With Amala App Suite give to your financial institution the best loan management solution that will make your operations easier. The system is dedicated into adding value to the Microfinance institutions and SACCOS with an effective control and transparent way and moreover facilitate the compliance of the financial institutions in accordance to the governing principles