- +255 766 521 258

- info@amala.co.tz

- Magomeni Watumishi House, Dar es Salaam.

Amala Self Service which goes with the name of Amala Yangu is a mobile application, supported by the Amala Core Banking system that is used by a client/member of the financial providers, be SACCos, Microfinance, AMCOS, Community Bank etc. It empowers clients/members of the financial institution to access their data and be able to perform some of the activities in their accounts.The followings are some of the features available in the application.

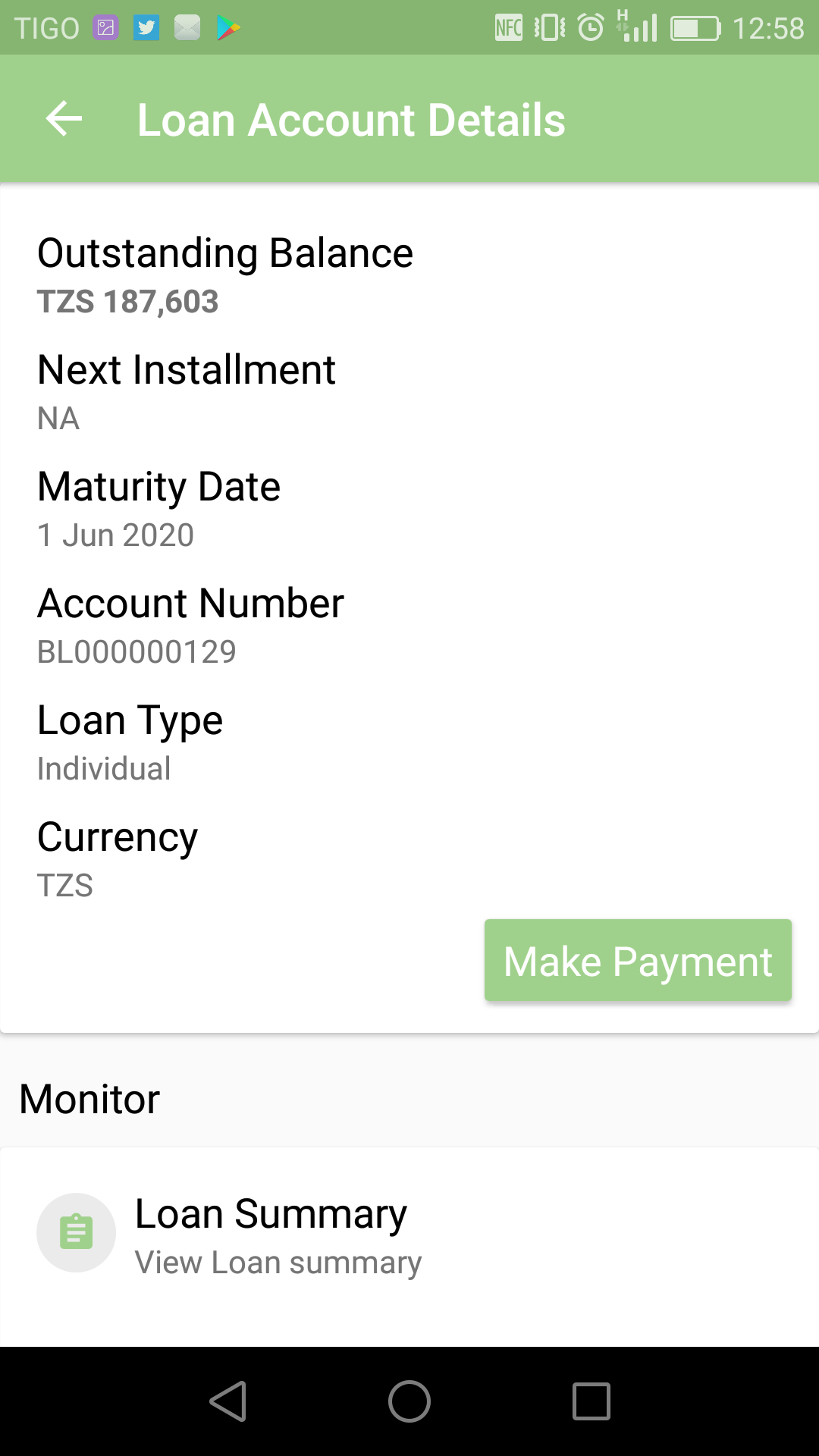

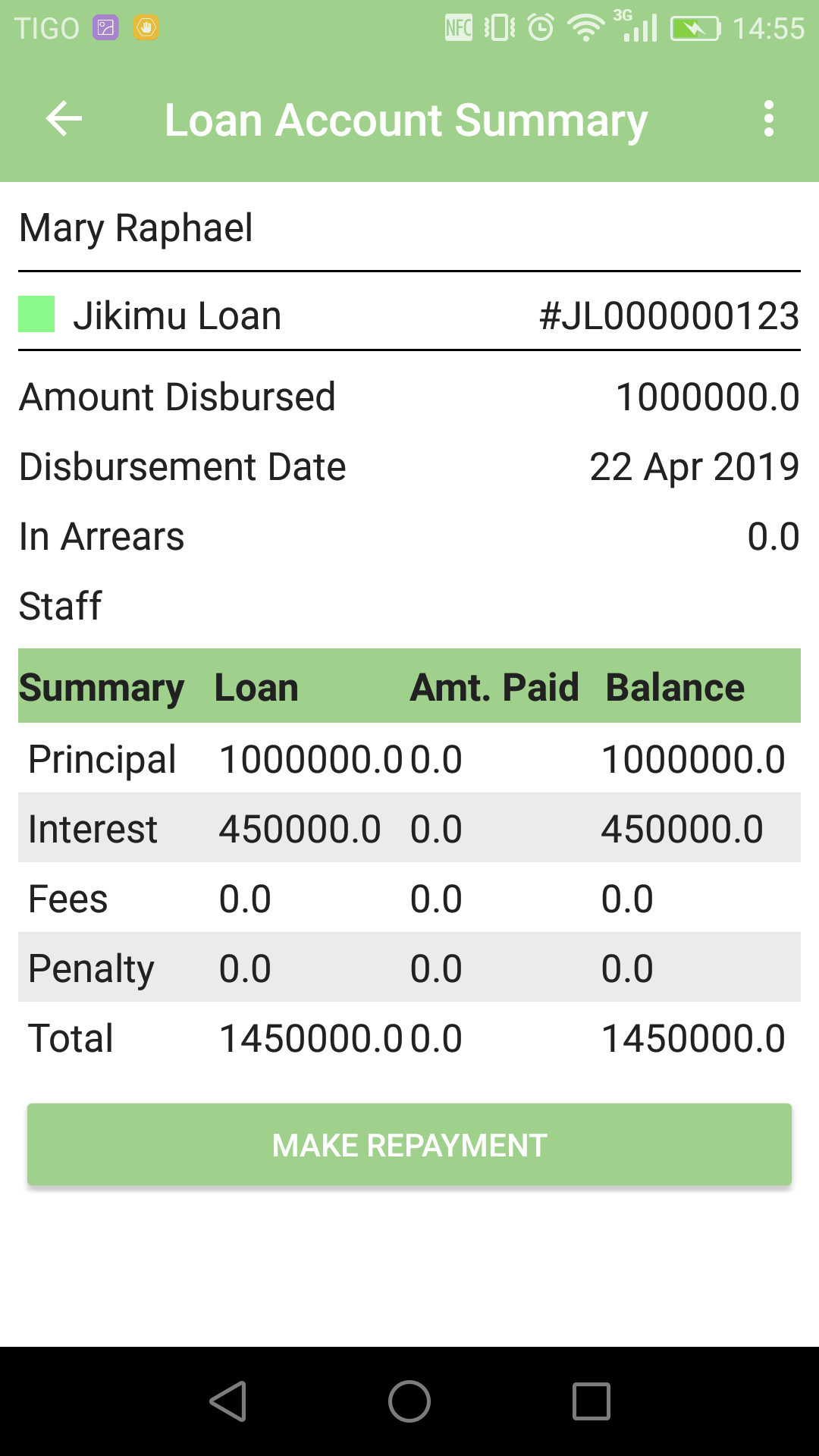

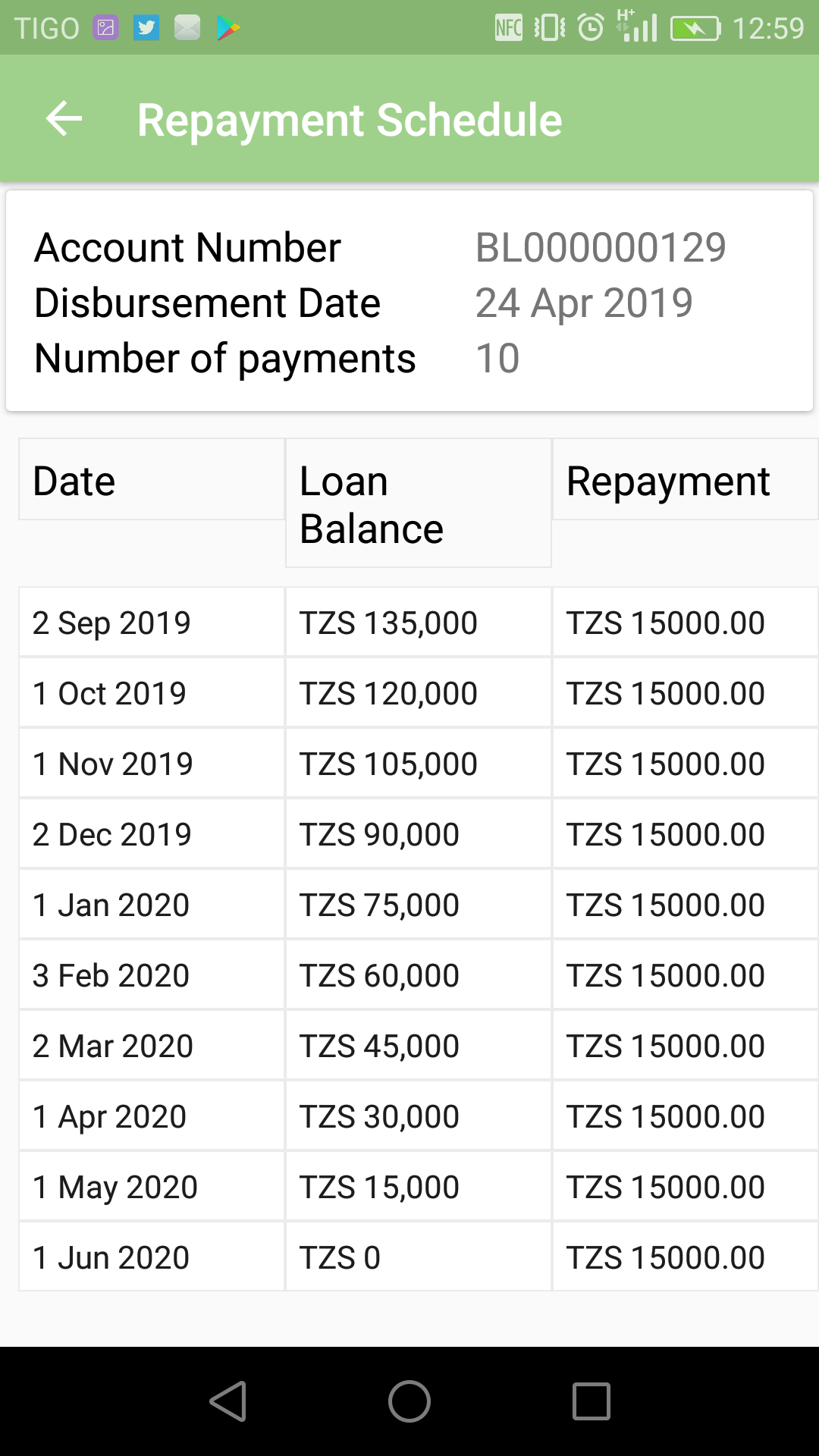

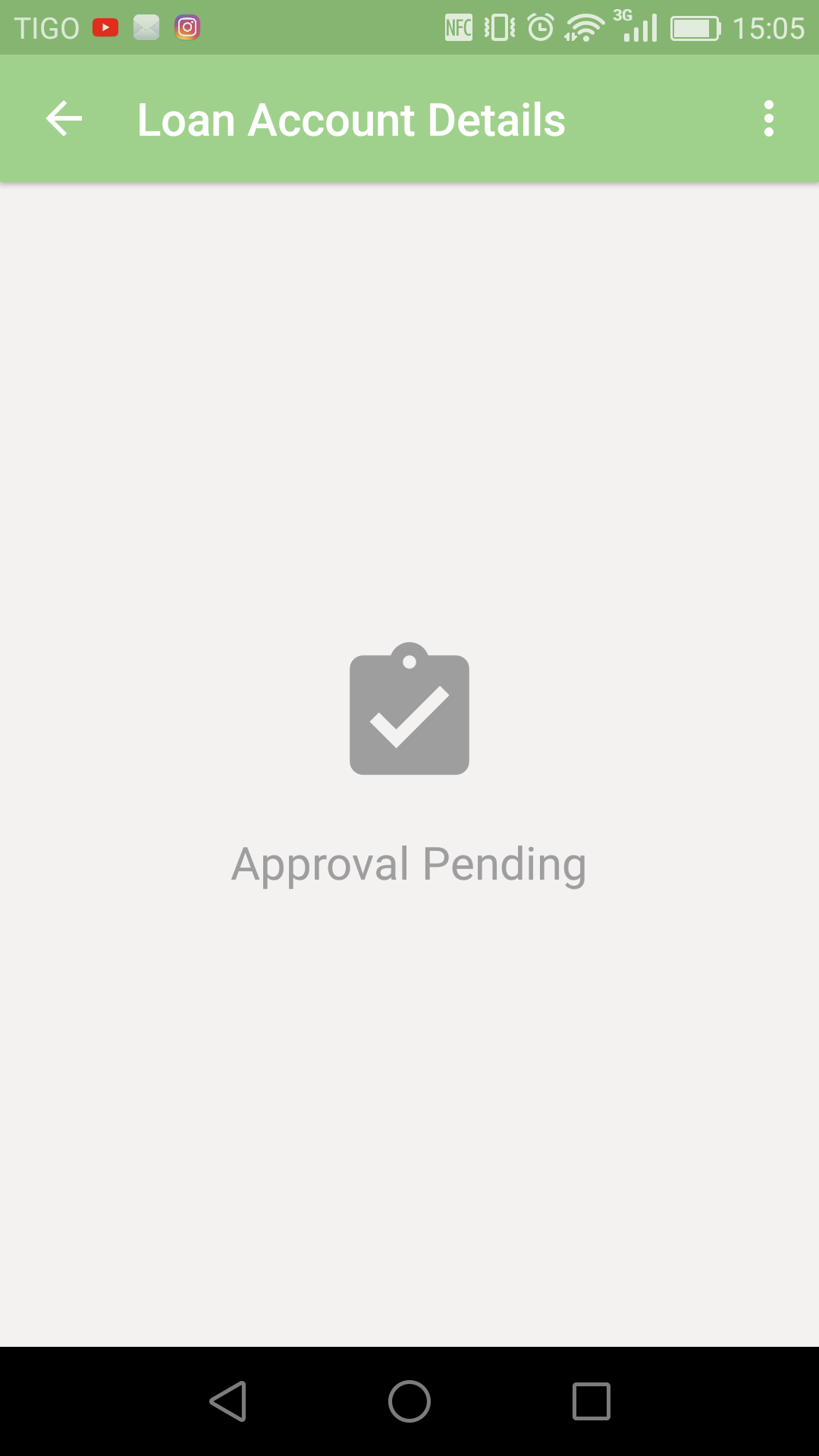

Loan Details

The Amala Yangu provides loan details of the loans that client/member own, they can see the loan summary, the overview details and the repayment schedule of the loan. All these details are per loan, client/member will be able to view the loan details of different loans that s/he applied.

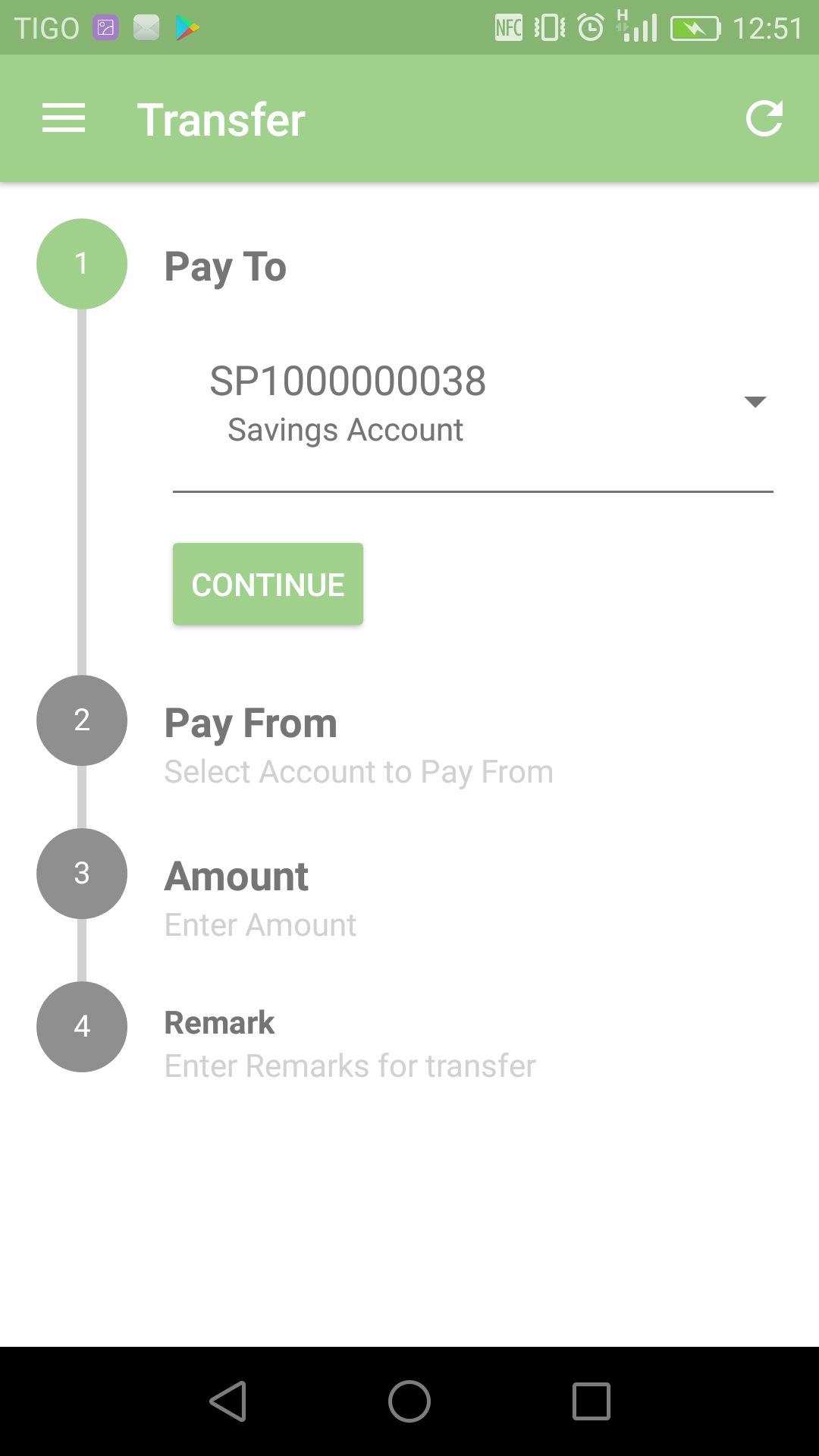

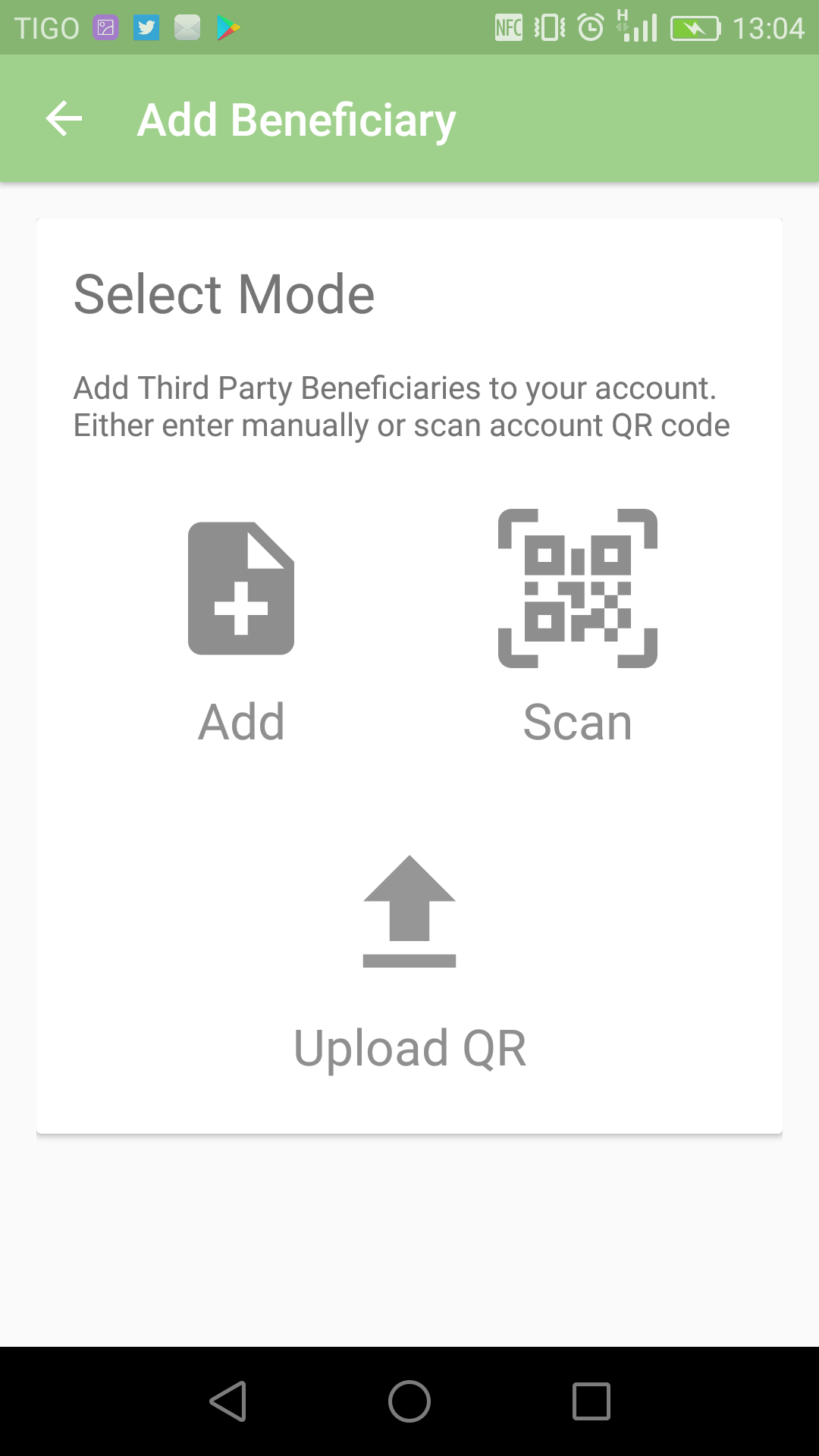

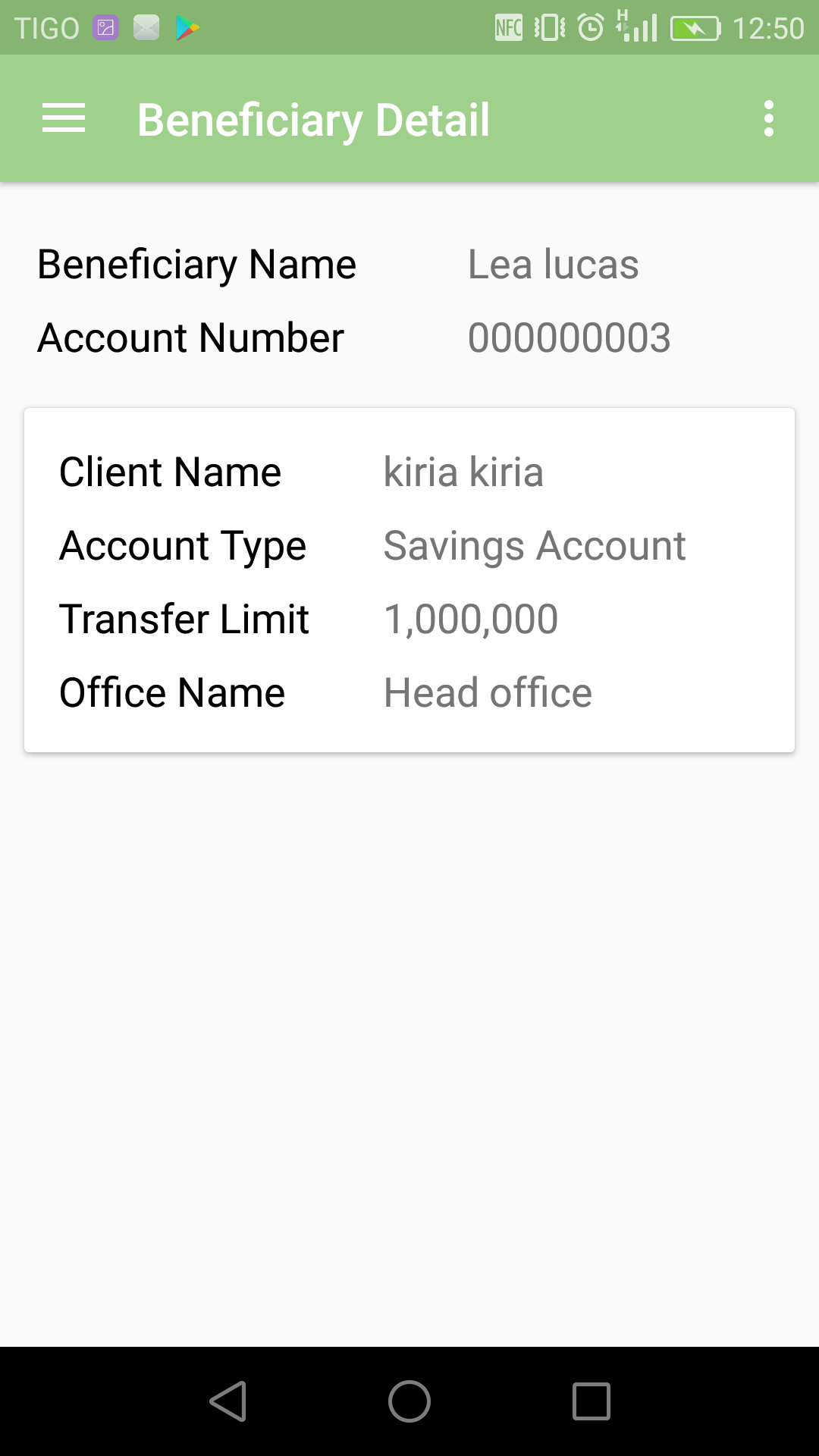

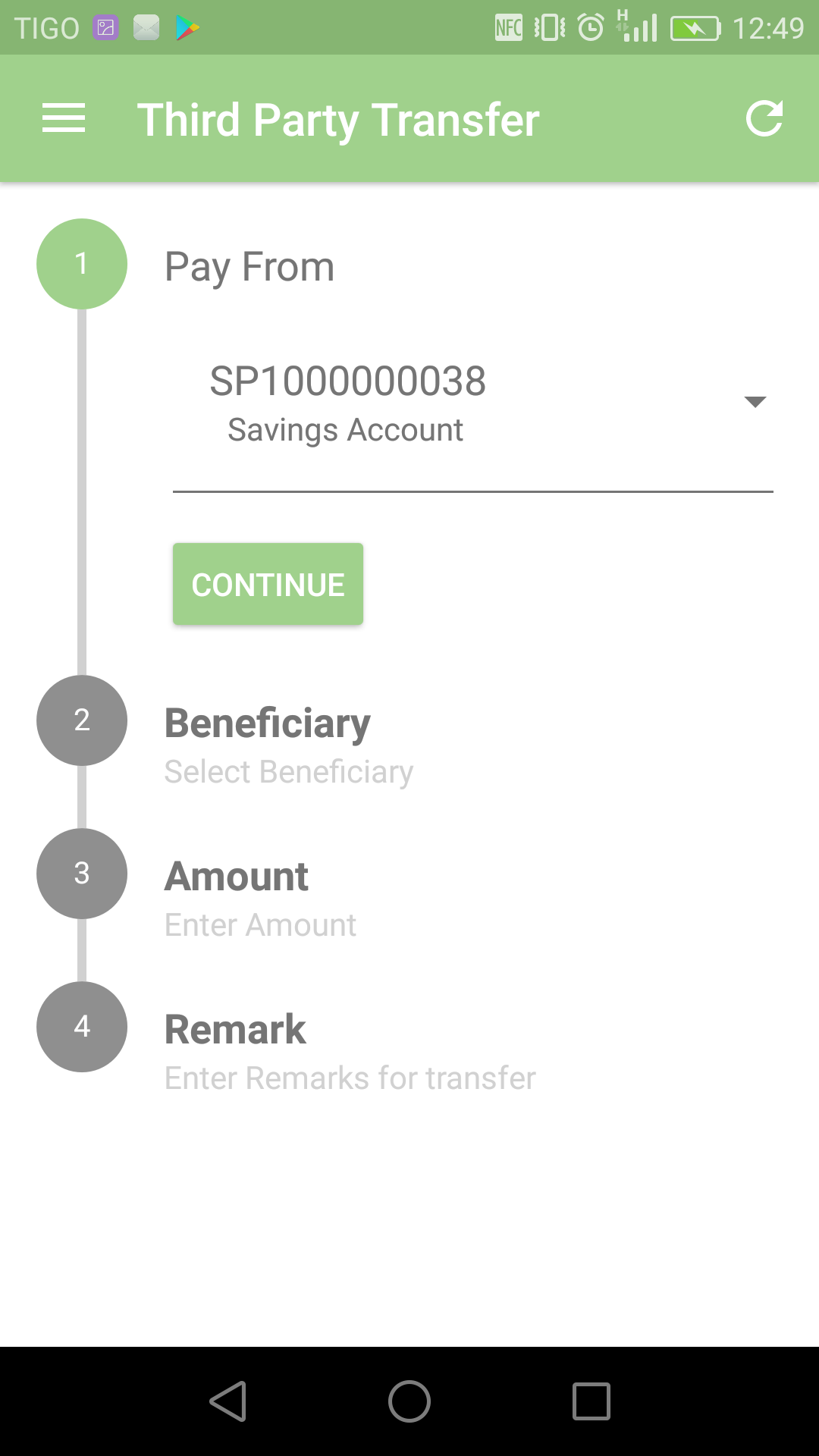

Beneficiaries Management and Third Party Transfer

The Amala Yangu provides the ability for client to create their beneficiaries, also to transfer some fund to the saving account of their beneficiaries or paying their loans.

List Of Loans

The Amala Yangu provides the list of all loans that a client with the account in the app have to the financial provider, in the list, the loans are showed with their status and the outstanding amounts. Client/Member can know the progress of the loan s/he applied (if it is still in approval process or just waiting for disbursal)

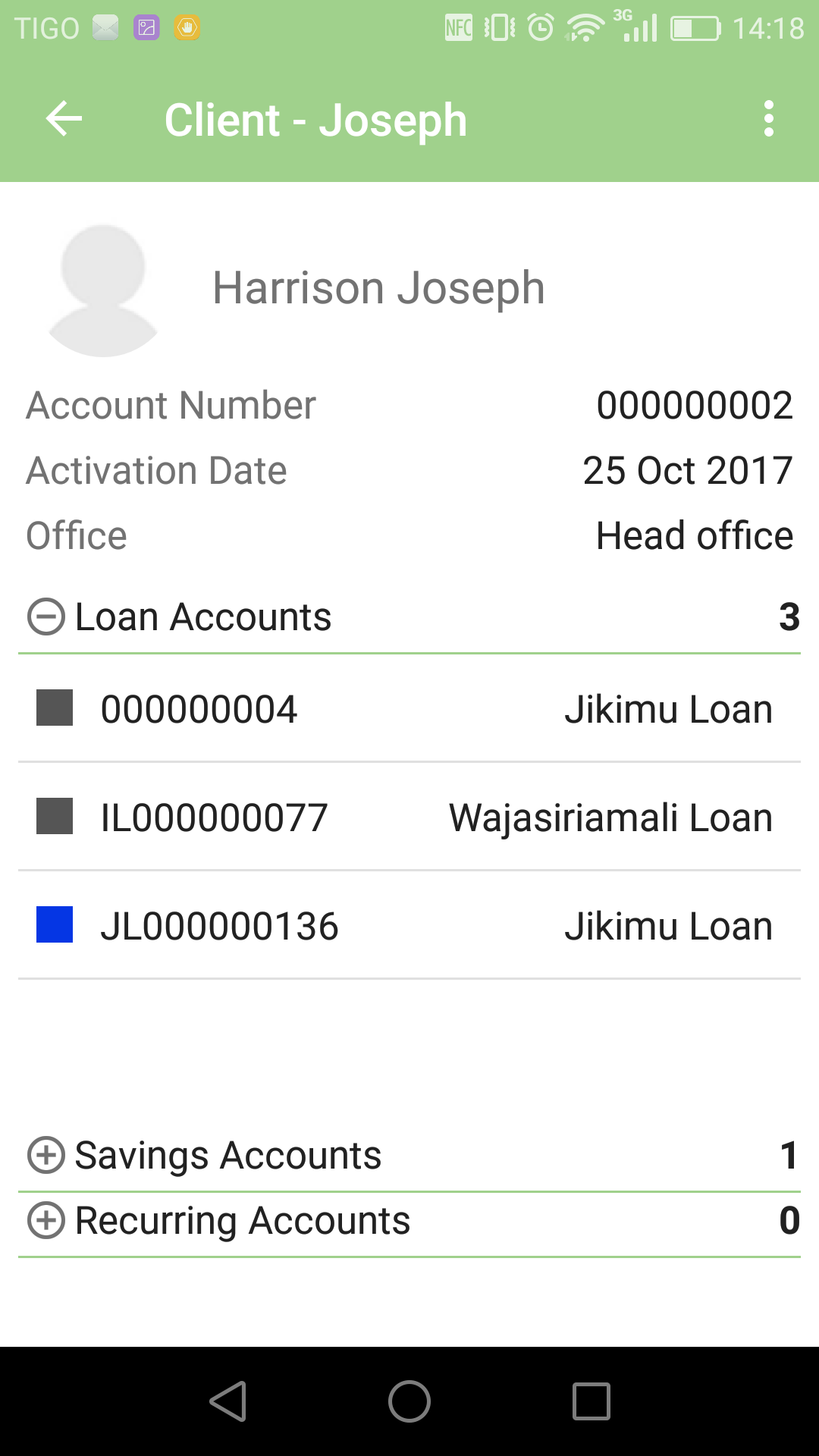

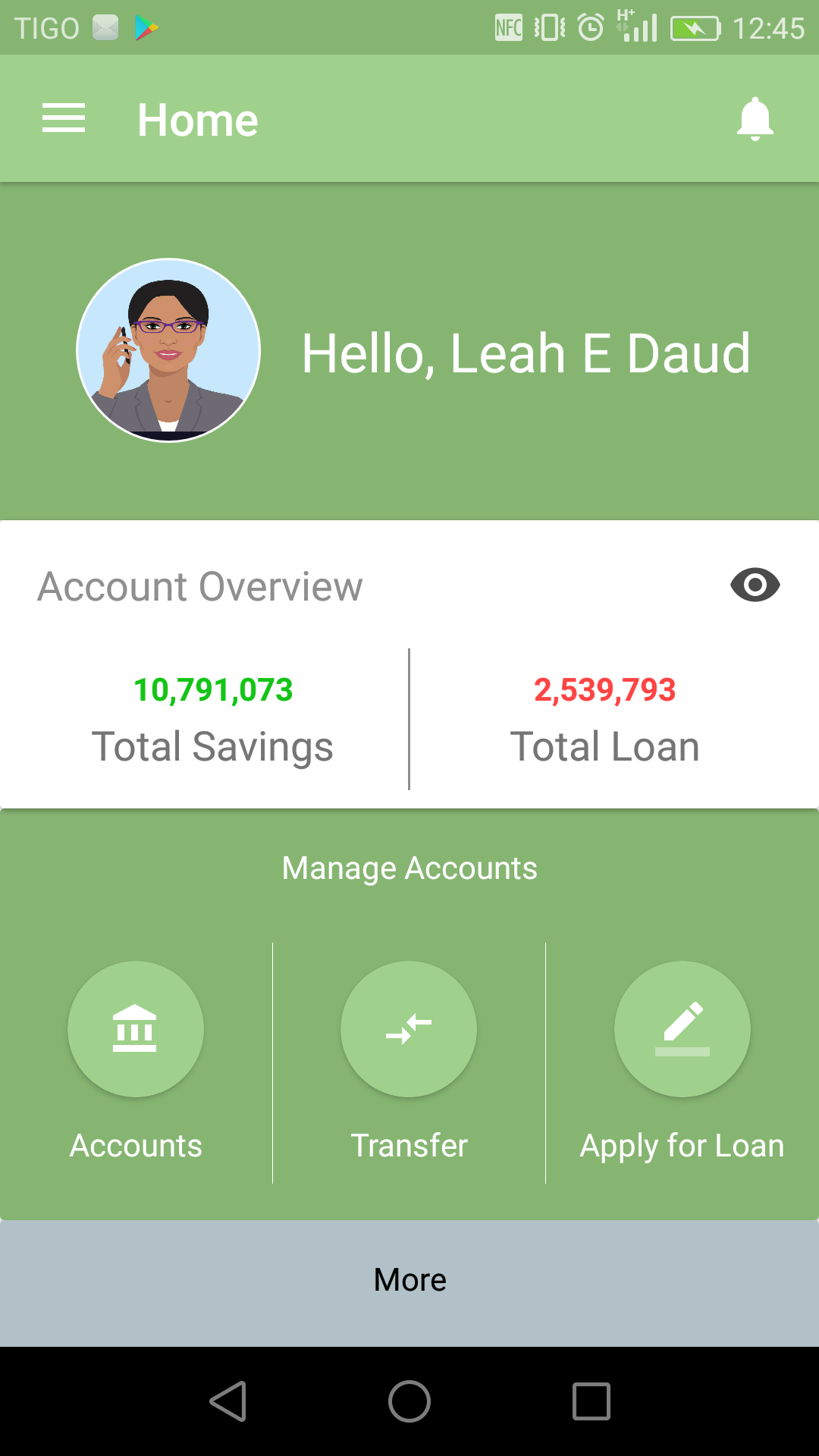

Client/Member Profile

The Amala Yangu has a profile with the picture of the client, total of the saving balance, total outstanding amount of the loans s/he has and link to some operations that a client can perform with relating to his/her accounts.

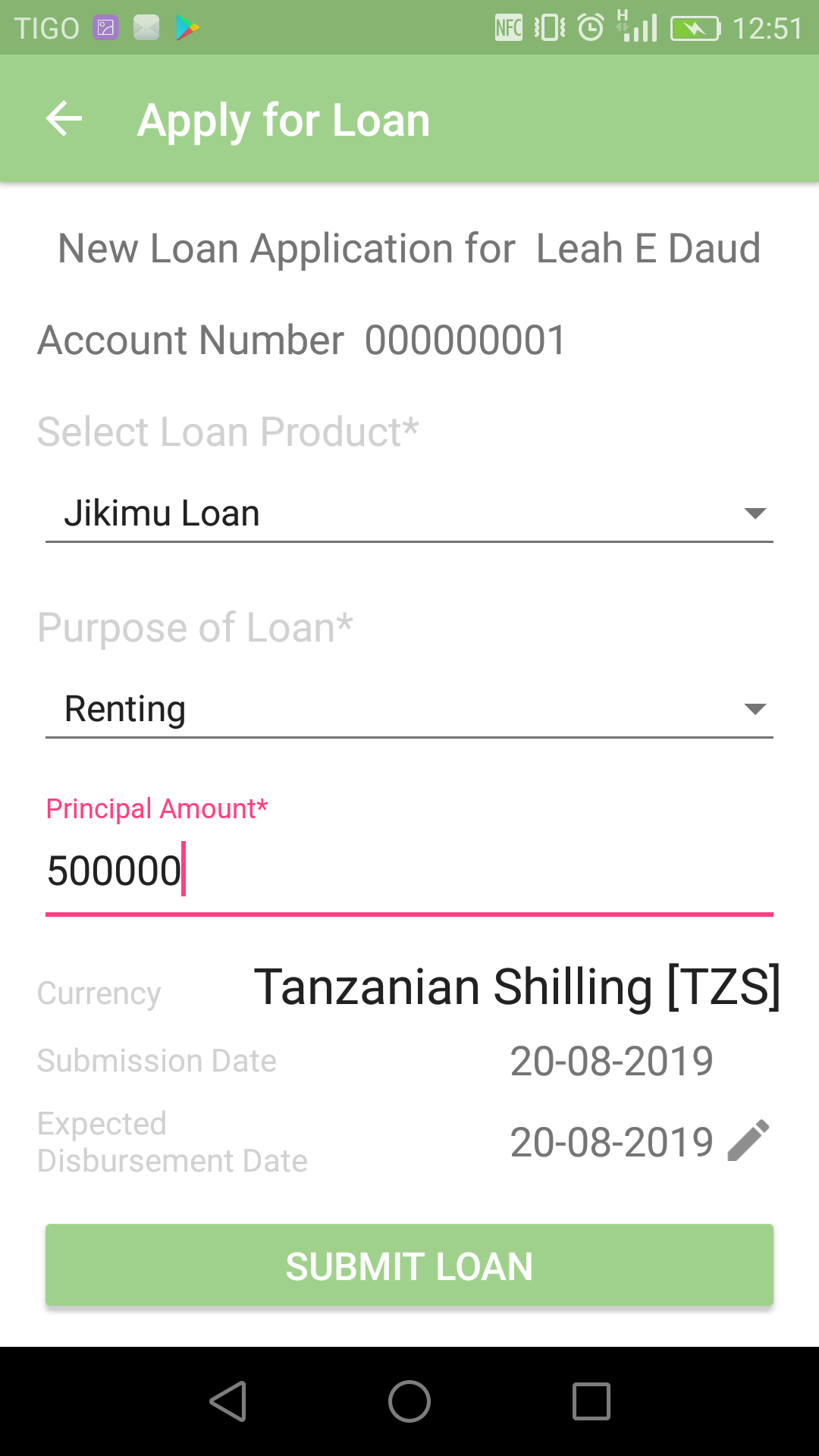

Loan Application

The Amala Yangu gives client/member ability to apply for a loan and fill all necessary primary details that will be needed, with this, it has reduced the work to loan officers to fill even basic information that can be filled by a client. The approval process will still be handled in back office.

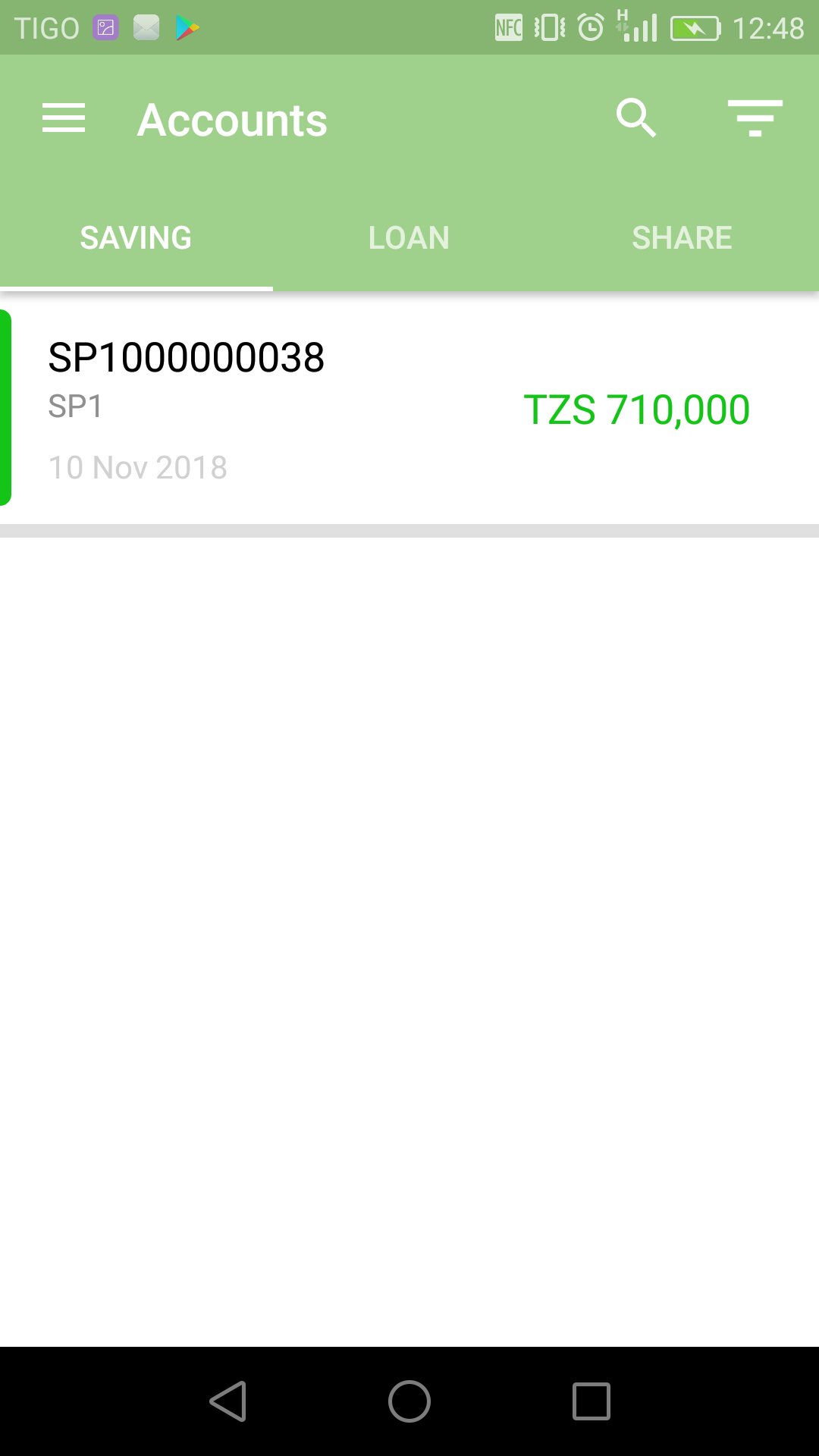

Saving Account

The Amala Yangu provides to a client a privilege to view the list of all their saving accounts and their details.

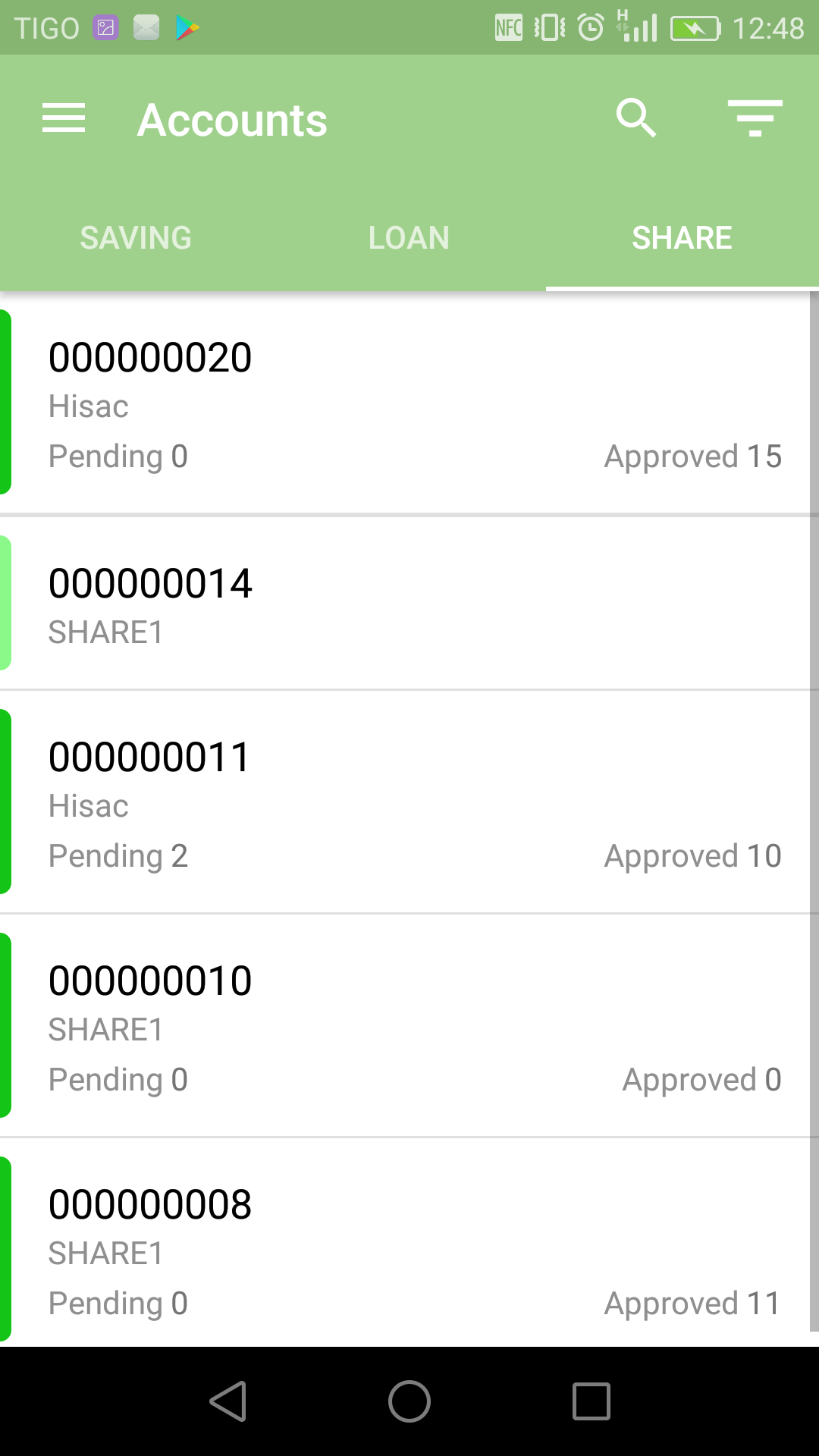

Share Account

The Amala Yangu provides to a client a privilege to view the list of all their share accounts and their details. It also shares the number of shares that are already approved and those that waiting to be approved.

Transfer of Fund

The Amala Yangu allows a client to make repayment of a loan by transferring fund from a saving account to a loan account, to make a deposit or withdrawal by making a transfer from one saving account to another.