- +255 766 521 258

- info@amala.co.tz

- Magomeni Watumishi House, Dar es Salaam.

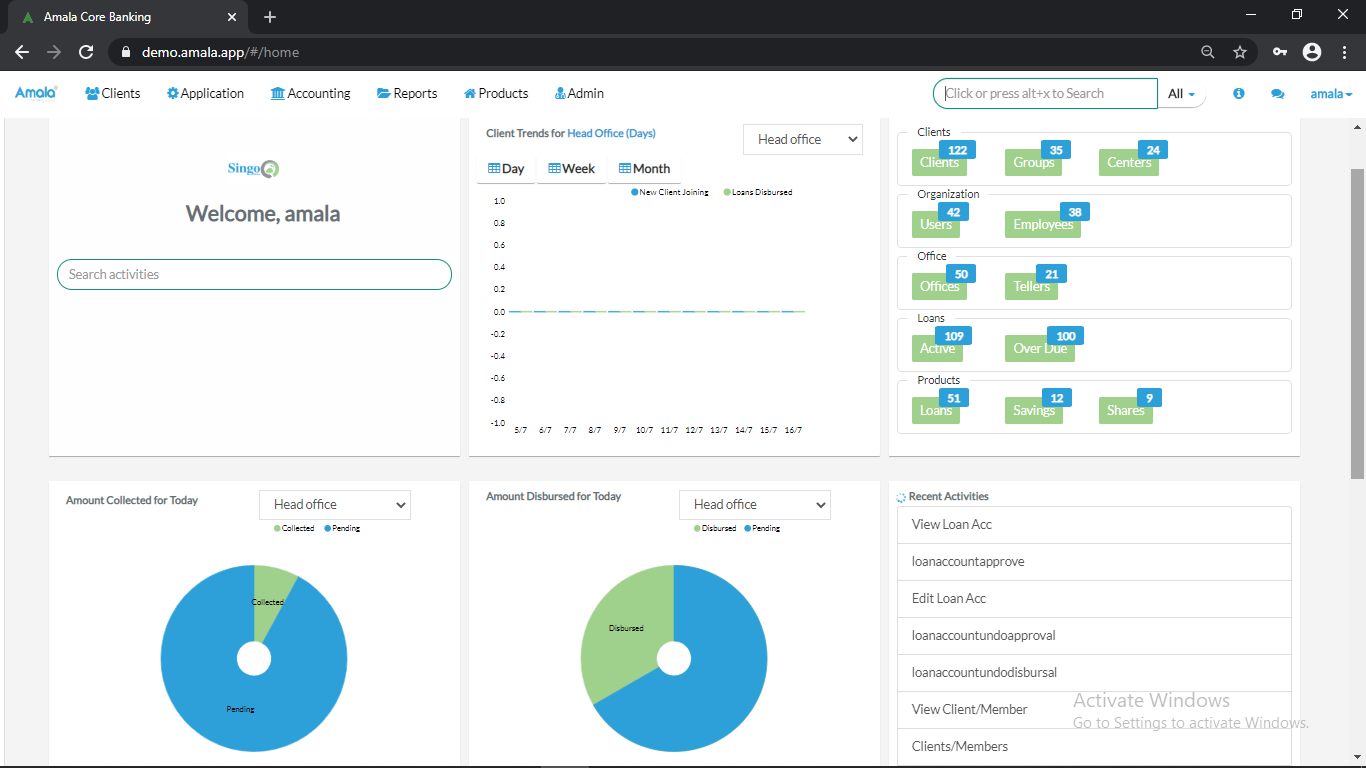

User Friendly

The Amala Core Banking has interfaces which are easy to use. The dashboards which can show you number of clients/members registered in a certain day, number of loans disbursed in a day. Also there are dashboard to show propositional of amount disbursed and that waiting for disbursal, amount collected for the day and that expected to be collected. The user of the system does not need IT background to be able to use the system.

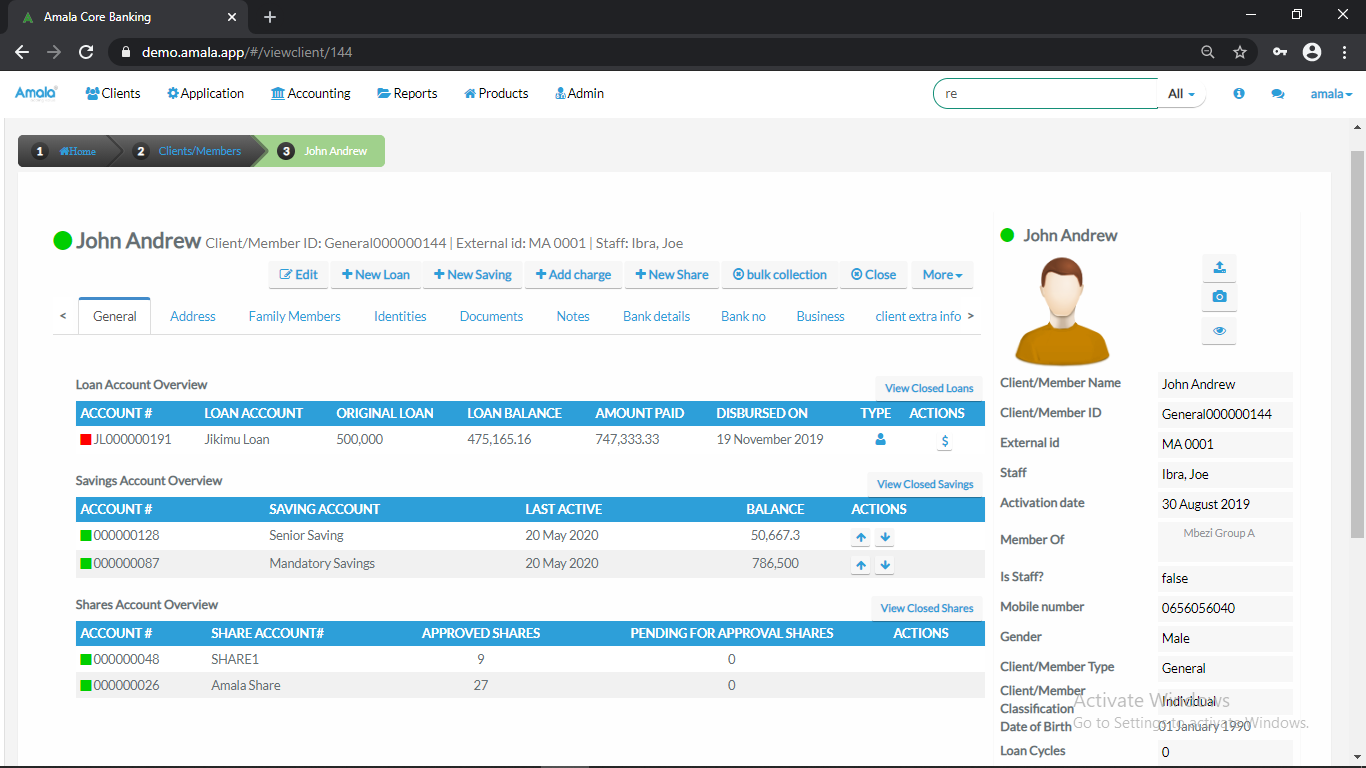

Client Management

The Amala Core Banking allow an institution to manage their clients/members with all their data in the system. All the operations concerning their clients/members can be done in the system in a best practice way. The system allow you to create custom forms to capture other information that might be unique to your organization but information like Names, Address, Family Members, Signature, Picture and other more have by default fields to capture them.

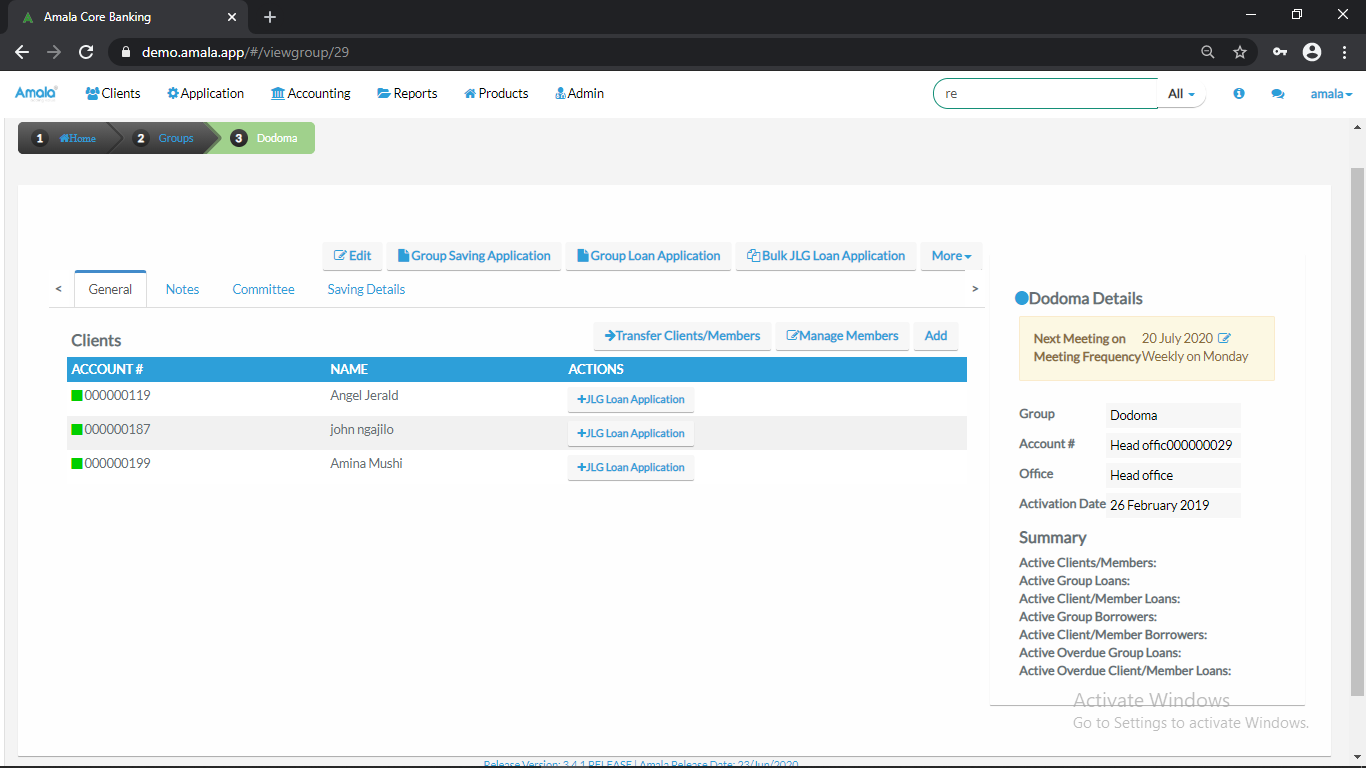

Group Management

The Amala Core Banking support management of groups, from registration to managing the clients that are in the groups. With groups in the system, you can attach the members, apply for the loan of the group, have a saving account of the group and schedule the meetings.

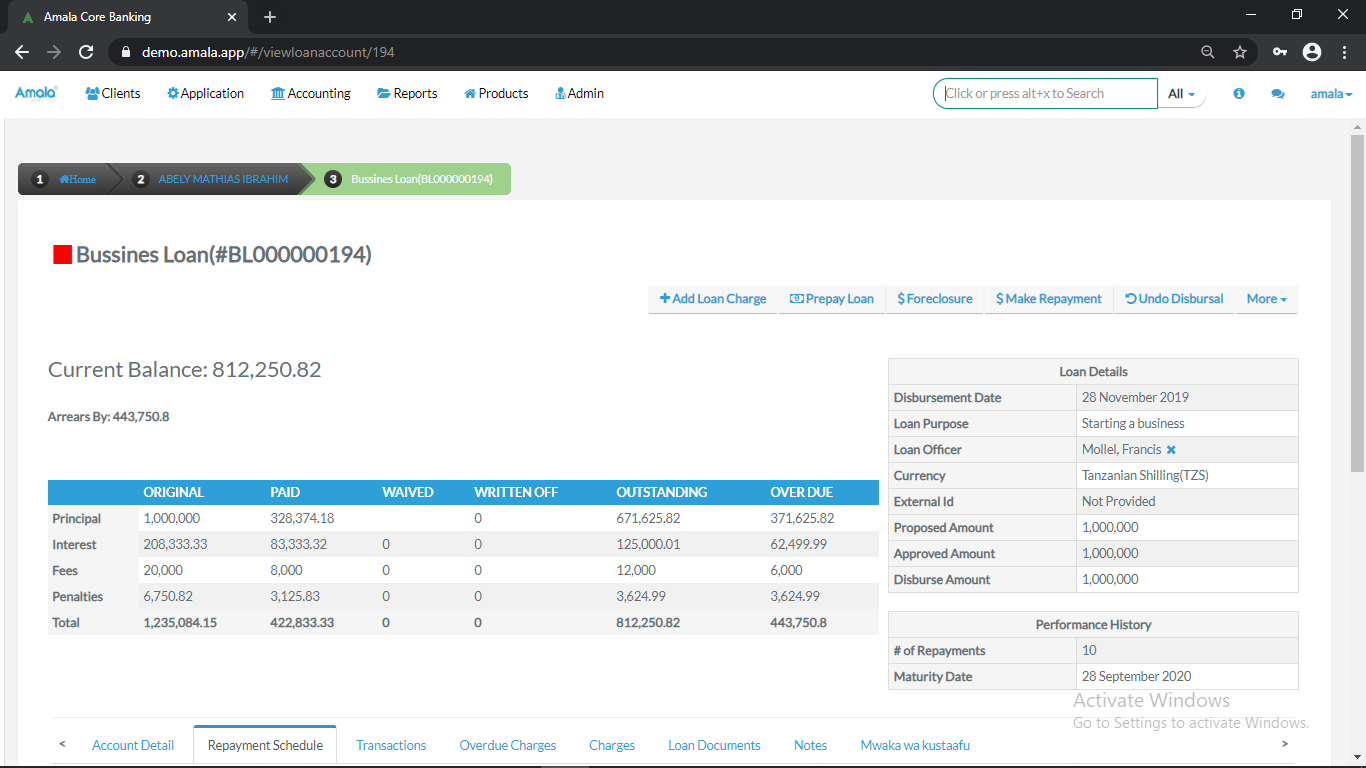

Loan Management

The Amala Core Banking system offers a full loan management module with processes that fit the best practice of Financial Service Providers (Microfinance or SACCOs ). With limitless number of loan products that can be created, a user can customize the product as much as she/he wants with variation of loan terms, repayment numbers, interest rates, range of principal allowed, guarantors, arrears tolerance and other more. With this flexibility, the system guarantee to grow with the financial service provider. The profile of a loan shows the necessary information about the loan on the overview and even label different color when the loan is overdue to alert loan officers.

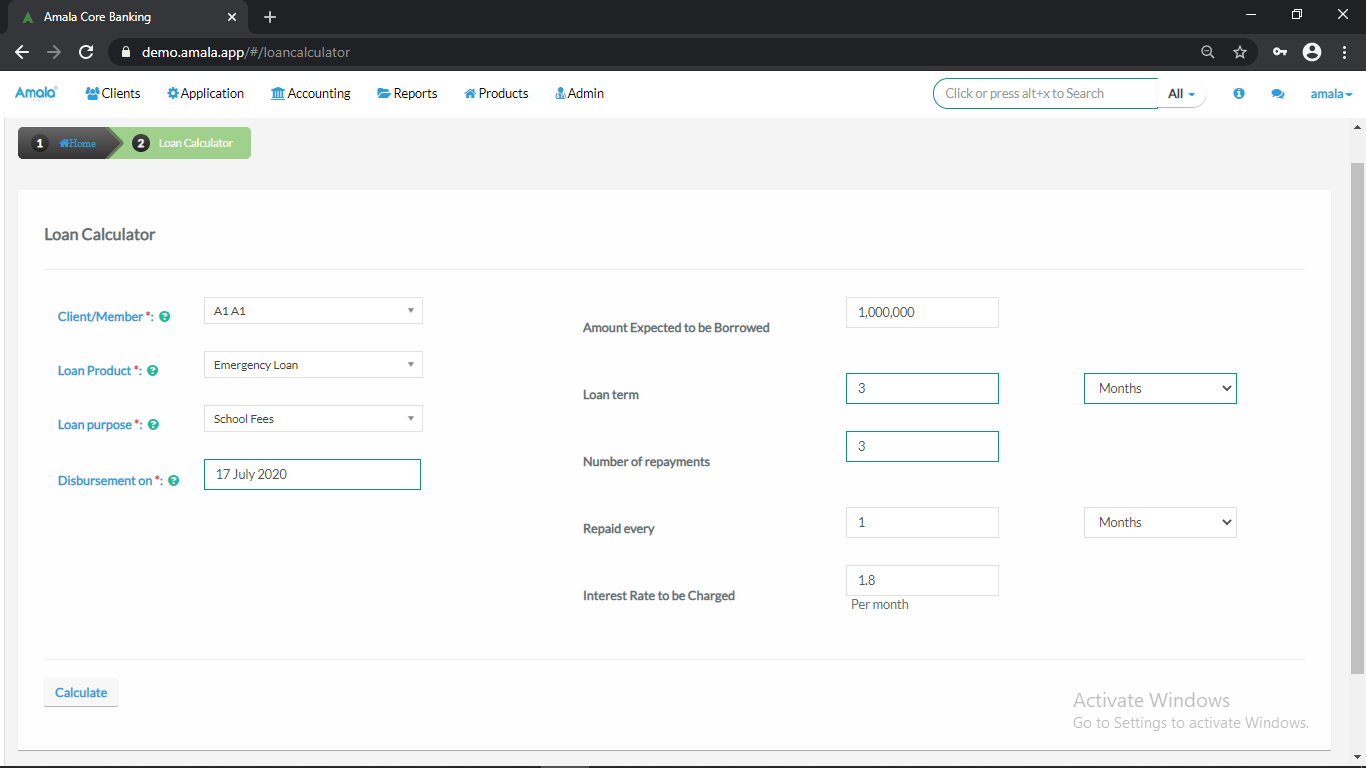

Loan Calculator

The Amala Core Banking has simplified the work of loan officers when they want to answer clients question “If i take X amount and i want to pay in Y installments, how much will i have to may in one installment? “. By using a calculator, loan officer can just feed in the data and the system will calculate and give the answer in a single click.

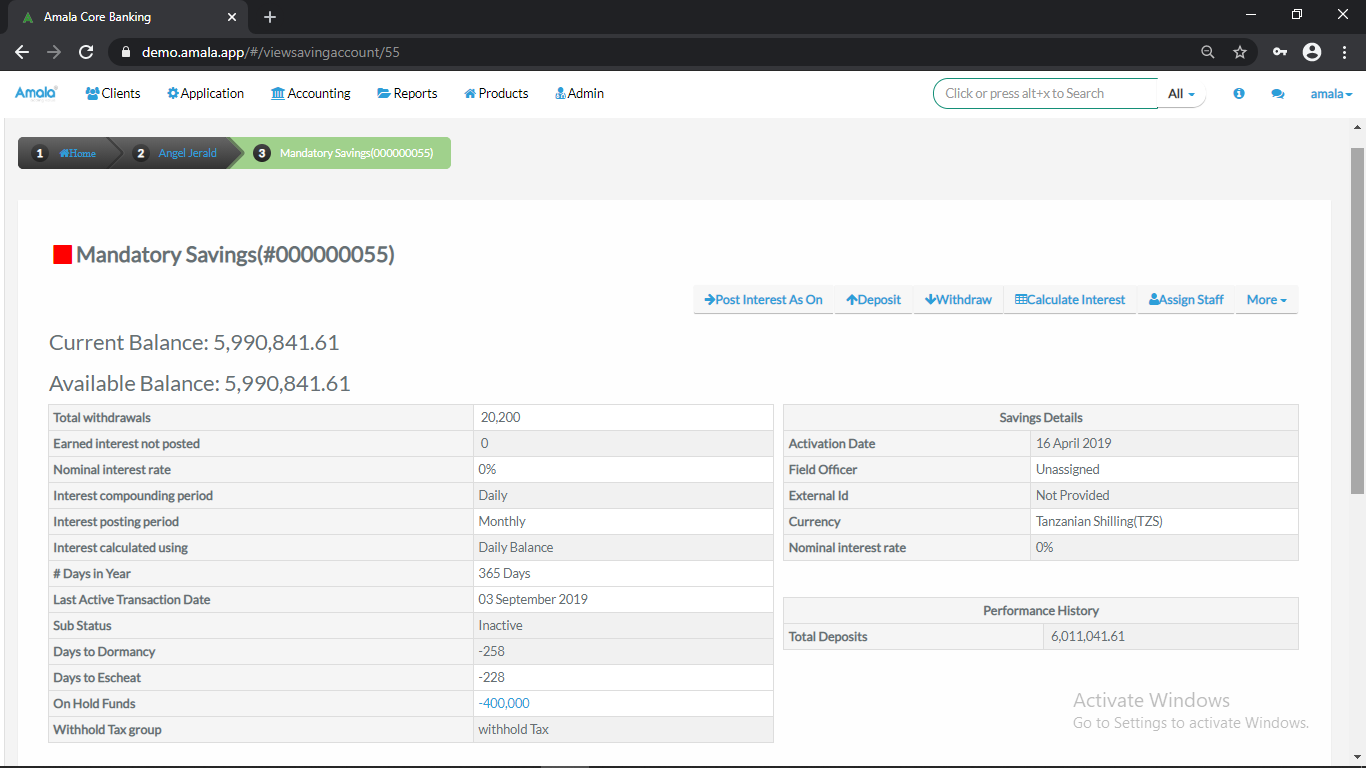

Saving Management

The Amala Core Banking offers the module of saving management with the processes used in opening a saving account and managing it. With additional features like withdrawal fees, transfers from one saving to another and paying a loan using a saving balance.

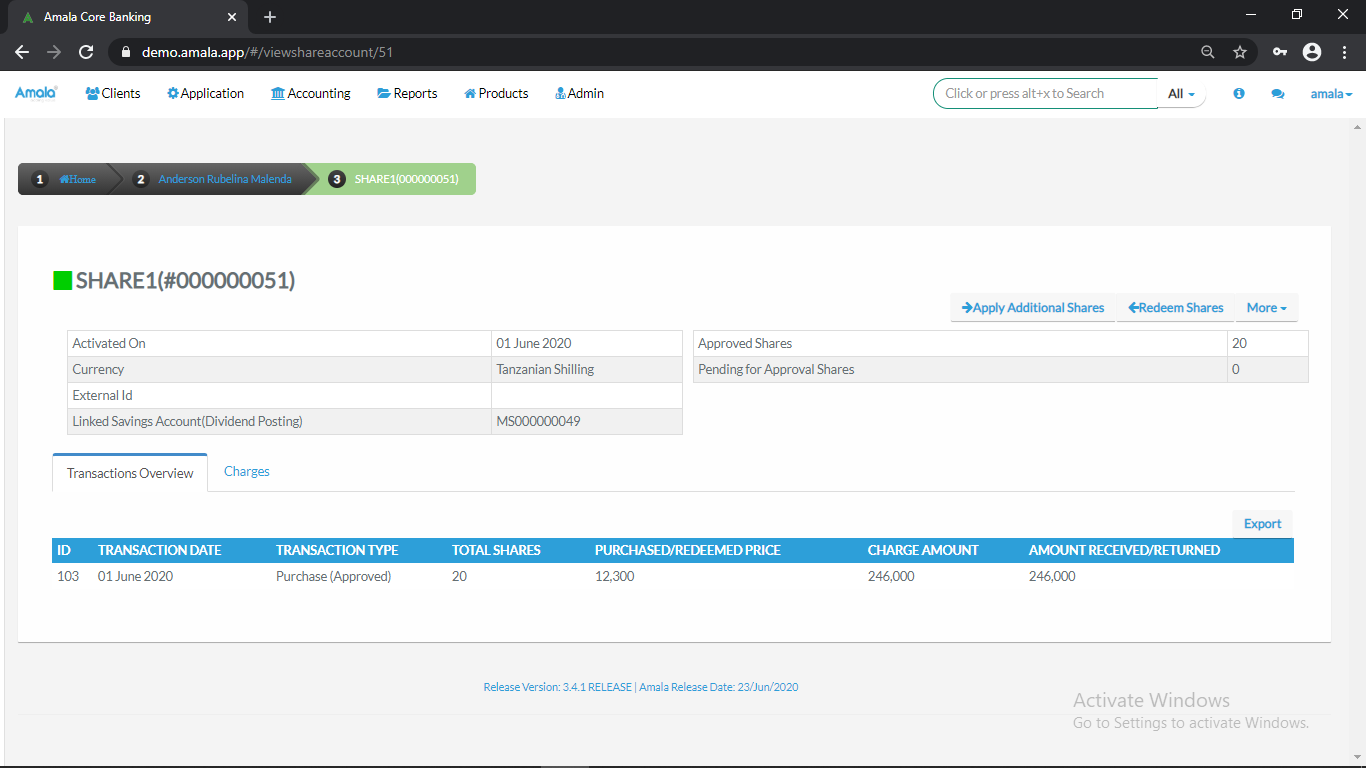

Share Management

The Amala Core Banking have a full share management module for SACCOs that share is a very important product. It allows to define the unit price of the share The member will be able to purchase shares and redeem shares, will be able to know the number shares they have and how much they are worth.

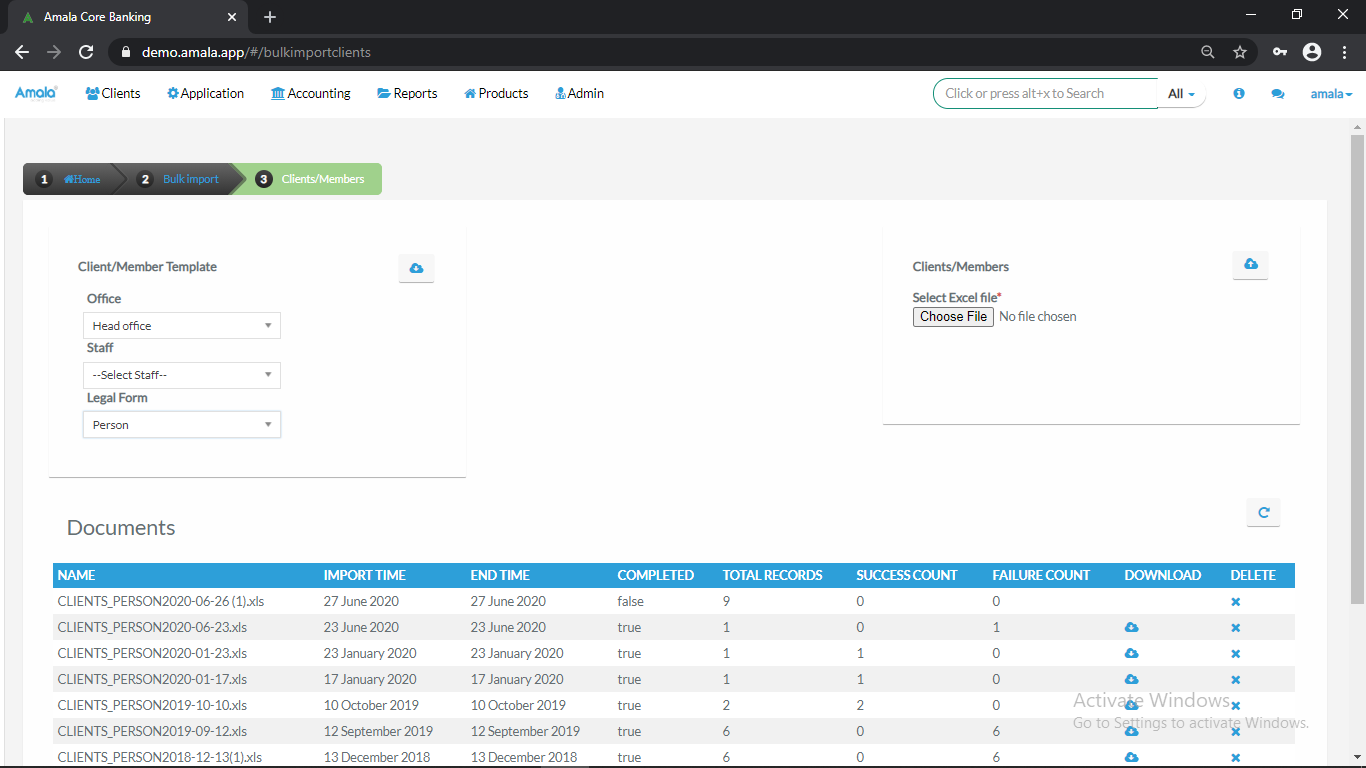

Bulk Importation

The Amala Core Banking allows you to import data in bulk to reduce the time that you could have used to input on data at a time. With bulk importation tool integrated in the system, you can import offices, employees, users, clients/members, loans, savings, shares, guarantors, loan repayments, saving transactions, etc. The system also allows you to download later for reference.

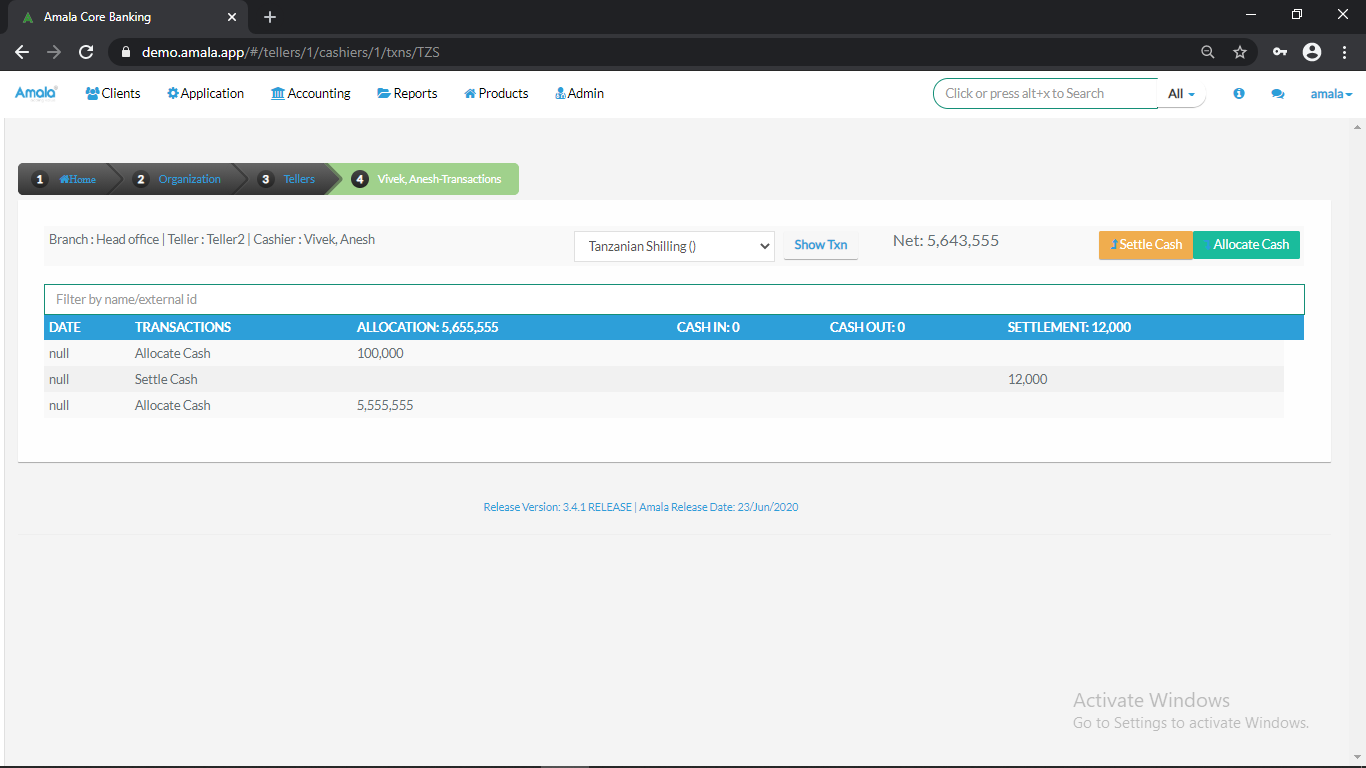

Teller and Cashier Management

The Amala Core Banking allow for the financial providers which have a front office to manage their teller and cashier operations in the system. With this feature, they can create tellers and assign cashier in a particular tellers, allocate cash to cashier record all the in and out cash that are affected by disbursements and collections of money, and at the end of the day settle the amount left to a cashier for that day.

SMS Campaign

The Amala Core Banking is integrated with Infobip, service providers of sms notifications to allow to send sms when a certain action is performed in the system. clients can get notifications when their loans are disbursed, when their loans are due or the due period is arriving, when a withdrawal and deposit is done in their accounts and other more actions that an institution will want to alert their clients/members.

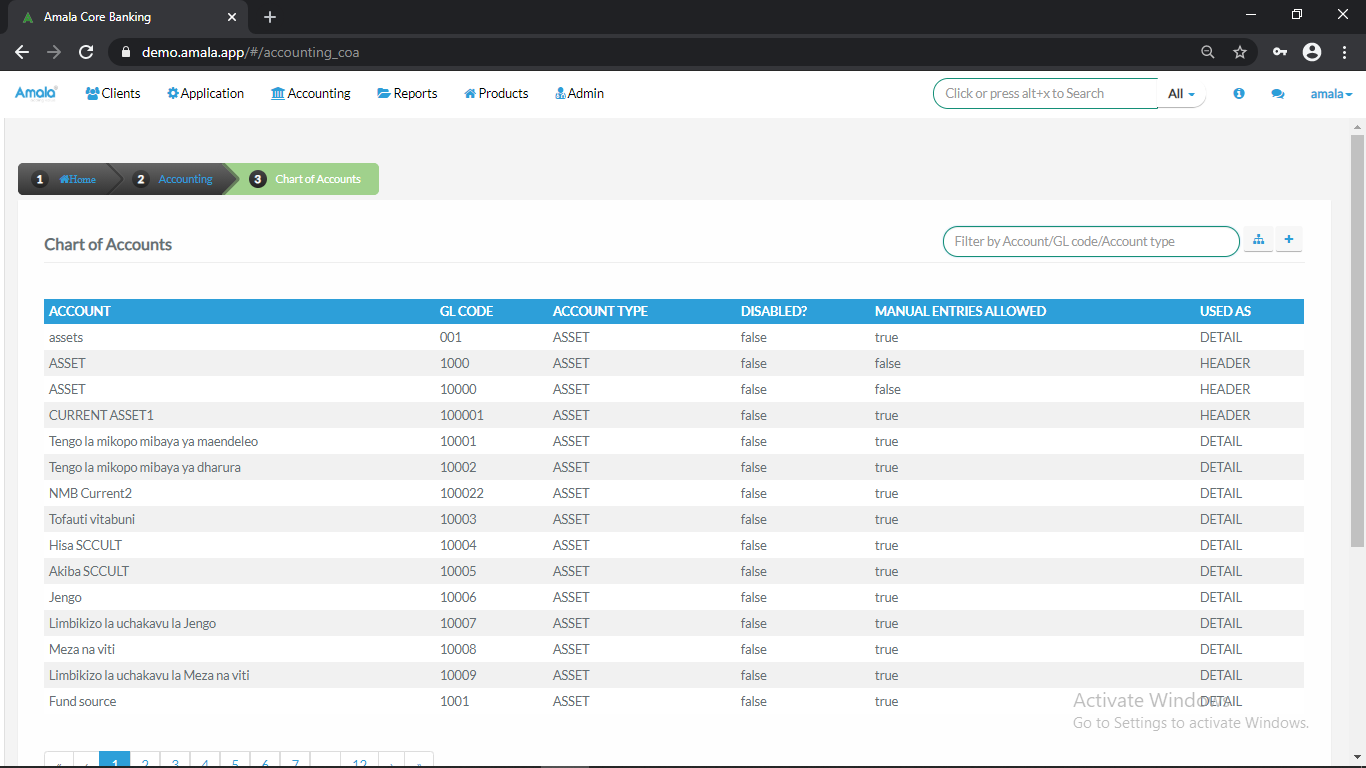

Integrated Accounting Module

The Amala Core Banking has a accounting module built in that allows to create chart of accounts and records all the operational transactions. Its gives you the additional of posting the manual entries that are not portfolio related. With this module, you will migrate your opening balances, capture all the accounting related information that were manually created (individual and frequent posting) and accounting related information from loans, savings, shares and charges that are automatically posted.

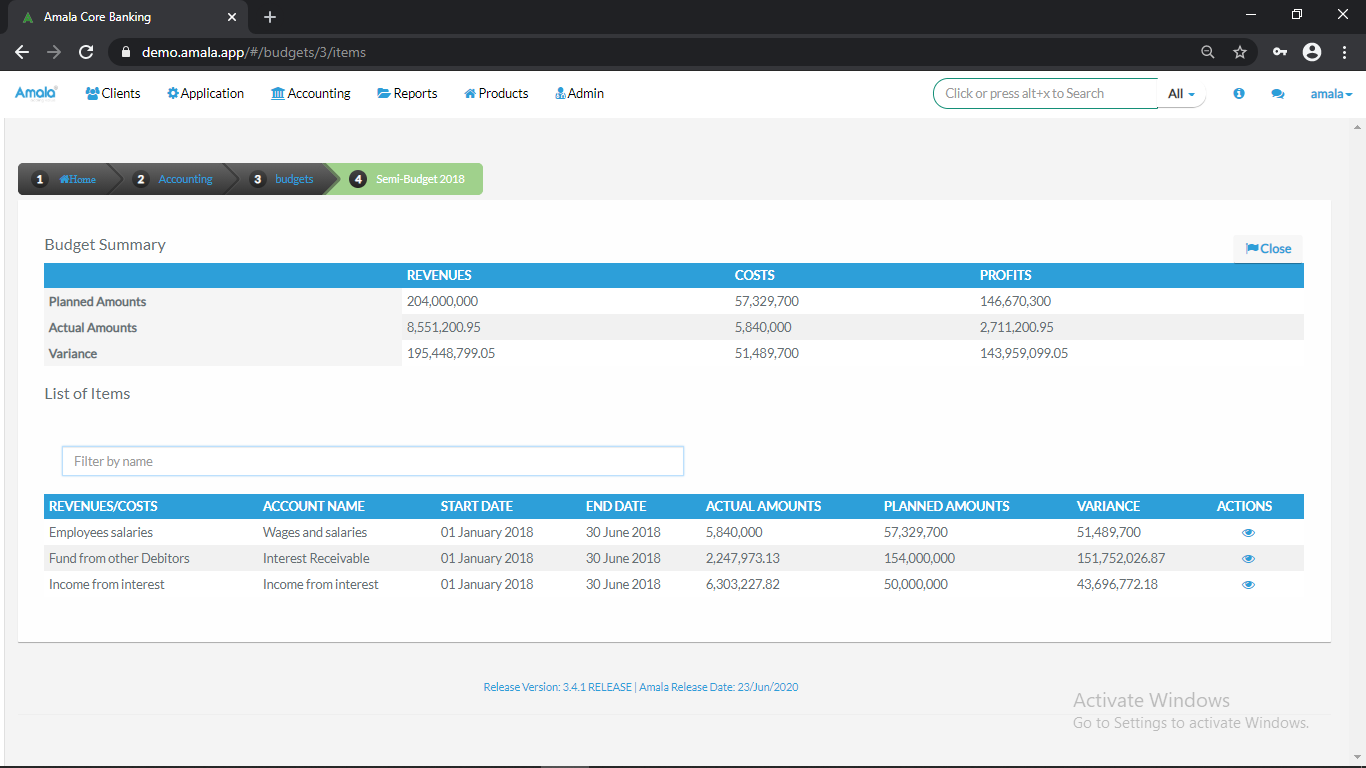

Budget Module

The Amala Core Banking provides you with budget module that allows you make your plans on how much you are expecting to get and how much you are expecting to spend. The feature allows you to create a budget of a year, semi-annual or a quarter.

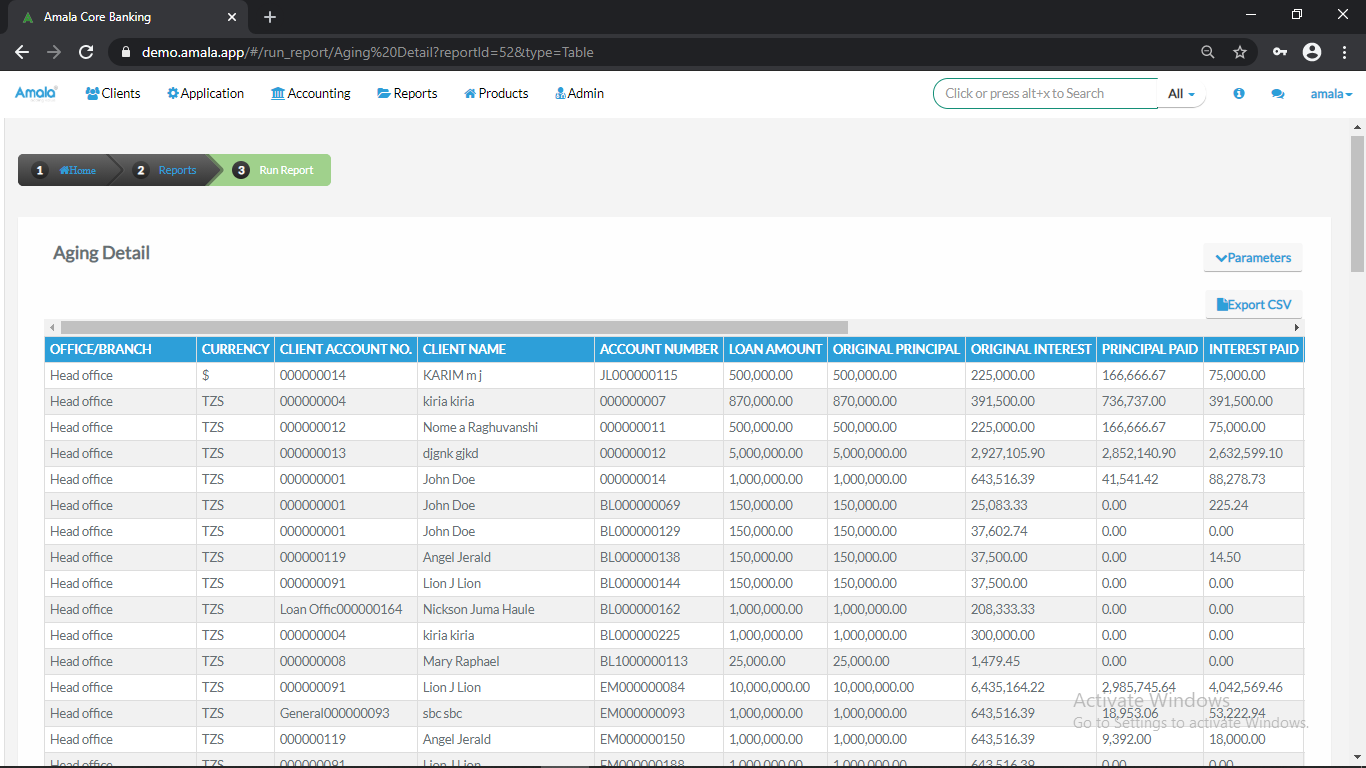

Quality Reports

The Amala Core Banking provide many reports providing information on clients/members, active loans, loans in arrears, loans that are expecting to be disbursed and other information of loans in different levels like institutional, loan officer and product level, saving account, share accounts and accounting reports. The reports are based on customer requirements we are serving. With addition to that, Amala Core Banking allows to create a custom report upon your requirement.

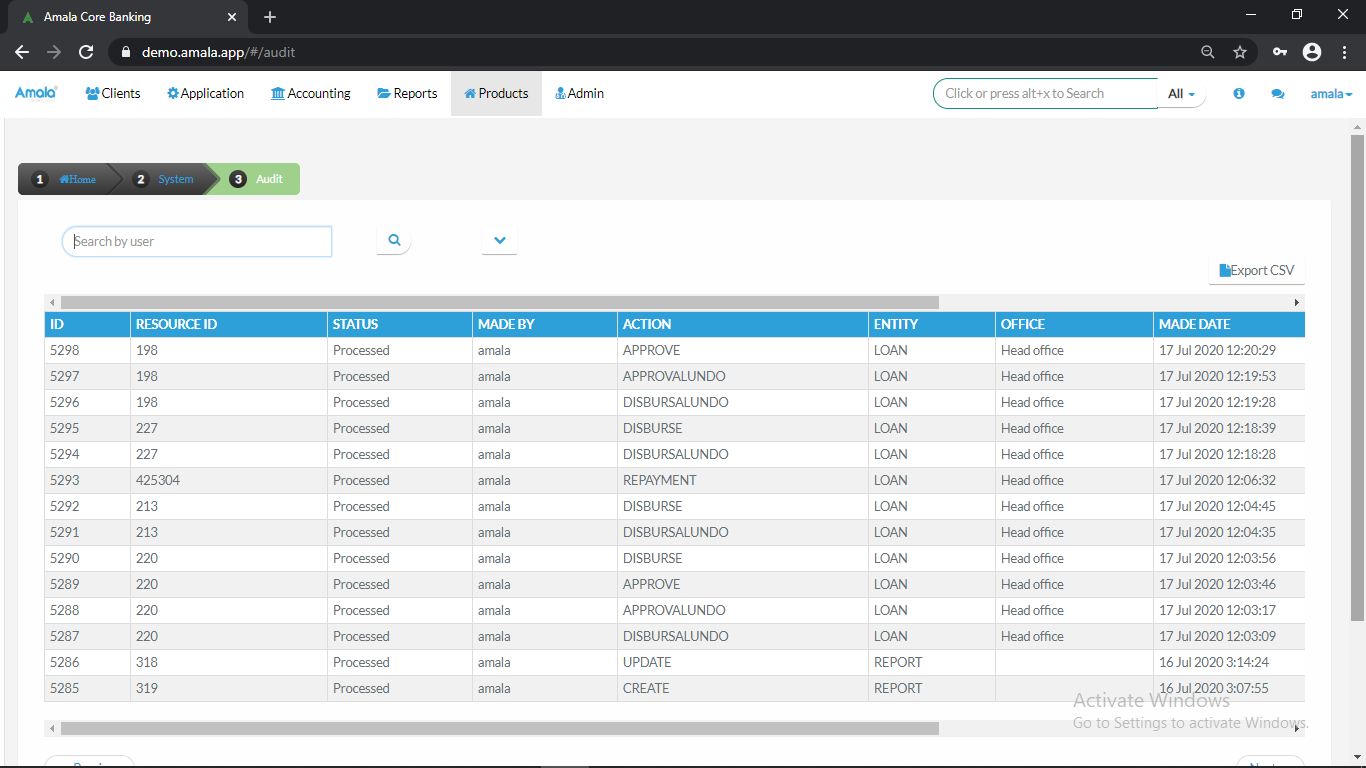

Audit Trial

The Amala Core Banking provides you with the details of who did what, when and at what entity. On this feature, user with privilege will be able to check anything that was done in the system in case something goes wrong, it will share the action performed, the maker of the action, the checker of the action and time of execution.