Everyone will need an extra cent!!! Money is always a scarce resource. If you choose lending as a business, believe me! You should know what not to do in the lending business as it will save you a lot of trouble.

In case you are wondering if it’s best business to start, I encourage you, it’s the best. Imagine just earning from just giving money you give you receive with something extra.

Of course! Everyone who starts a business has a bold ambition that it will grow. However, no matter how bold your goals are, you must have a business plan. A plan is the most important tool, it entails budget and how each stage will be implemented. One also needs to have passion and purpose for the business.

What is lending?

The activity of lending money to people or organizations which they pay back with interest. It is a two way transaction (A lender/Creditor and a borrower) which is governed by terms and conditions.

A borrower must agree to the creditor’s terms before receiving the loan. Often with a contract with terms prepared with a creditor/lender and carefully read by a borrower before accepting the loan. They will return the amount with interest amount depending on the lenders rates.

Now ! Here is what not to do in the lending business.

- Not defining clear vision

It’s literally not good idea to start a business with making profit as a primary vision. It is Cleary the aim, but one should explore a current community or business problem witch the existing competition hasn’t been able to solve. You must consider providing a great customer experience, friendly payment criteria, and low interest rates.

2. Not expanding financial knowledge and lending industry knowledge.

Research and educations on the microfinance and lending in particular, has contributed to the revising of theoretical/ traditional approaches to the production of knowledge regarding the new and competitive products and services. Understanding borrower’s behavioural patterns and social change. One needs to keep up with the trends. Join with forums, platforms and community which holds training, seminars and information about microfinance and lending sector one of these institutions is TAMFI

3. Not registering your business

You do not need to make this mistake!

The Central Bank of Tanzania (Bank of Tanzania) has finally issued the regulations governing Microfinance Business in Tanzania

These regulations are in response to the enactment of the Microfinance Act, Cap. 407 (Act No. 10 of 2018). According to the Microfinance Act, Microfinance business in Tanzania is classified into 4 tiers being:

Tier 1 –Banks and microfinance Banks (Deposit Taking Microfinance institutions).

Tier 2 –Credit companies and financial organizations (Non-Deposit Taking Microfinance Service Providers).

Tier 3 –Savings and Credit Cooperatives Societies (SACCOS)

Tier 4 –Community microfinance groups

Regulations requires that a person who intends to undertake microfinance business under Tier 2, must be established under the Companies Act or relevant laws, and incase for an individual money lender, register as a Sole proprietor. It is as well mandatory on registering such entity to include either of the words “microfinance”, “finance”, “financial services”, “credit” or “microcredit” in the name of such Microfinance entity.

Registration keeps the business safe and also protects you as the owner when faced with legal terms; so register and avoid all these troubles.

4. Launching or expanding too soon

Think Big but start small! And do not rush into a big picture before exploring the market, start will a small market niche and see how the business has been performing. One doesn’t just decide on a big decision without facts.

5. Not keeping track of the books

This is very important aspect for successfully lending business. However at times this becomes tiresome and one needs help

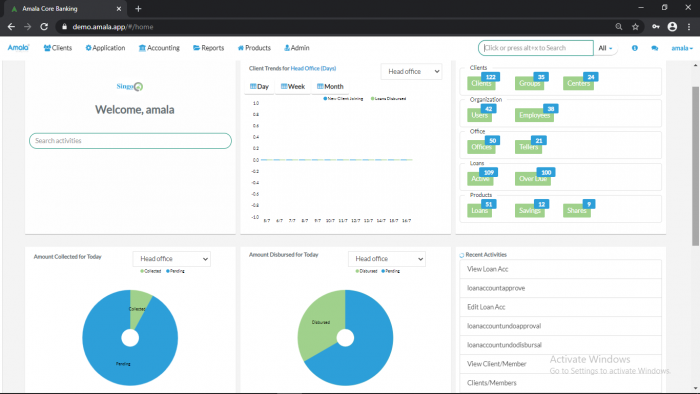

Good News! There is a helping hand from Amala App suite for accounting and record keeping in your microfinance or lending business.

Our Products

Amala Core Banking is a software solution for back office to SACCOS, microfinance and financial institution, its features include client management, loan management, saving management, share management, accounting, administration, reports including all regulator reports for microfinance (BOT) and SACCOS (TCDC).

It is possible to integrate Amala with Bank, Mobile money, and other payment system of your choice.

A mobile application for SACCOS members and microfinance clients to view their loan/saving accounts detail and apply loans without going to the office

A mobile application enabling the field/loan officer to work anywhere either online or offline collecting and recording loan repayments direct in the system while working on the field.

A mobile/web based application which connects both lenders and borrower. Practically a safe place where borrowers can get information on different lender prices. Lenders can get potential borrowers. A place where borrowers goes to make decisions. “where should I apply for a loan”

Instead of focusing on record keeping, enjoy the product and features of Amala App Suite which enables you to focus more on expanding your business and innovate new products and services.

6. Lack of Online Presence.

The COVID-19 pandemic has business owners starting to think differently about how they reach their customers. Ensure that all your online profiles are complete and up to date. It only takes a few minutes, but it goes a long way in keeping your customers informed. Create a website and ensure that you website is updated. You want to be able to give your customers the information they’re looking for as quickly and easily as possible, this should be your priority.

Explore on how business should maximize their online presence. Find a best website creators or digital marketing consultants or proffesion.

Thank you for reading!

And you now know some of the tips on what not do in a lending business. As stated at the beginning of this blog, it is a best business to start but make sure you follow the tips here and from many other industry experts and thank me letter!